Sf property tax rate

Couples will get 100 so long as. The unsecured property tax rate for Fiscal Year 2020-21 is 11801.

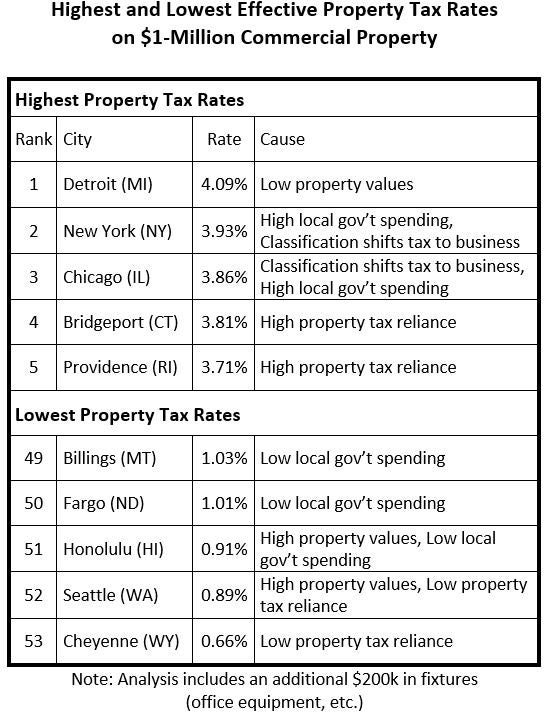

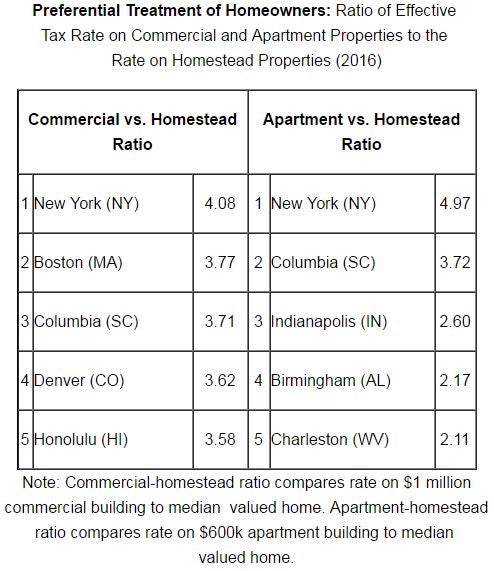

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Enter only the values not the words Block or Lot and include any leading zeros.

. Property owners pay secured property tax annually. Our San Francisco County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. 555 Capitol Mall Suite 765 Sacramento CA 95814.

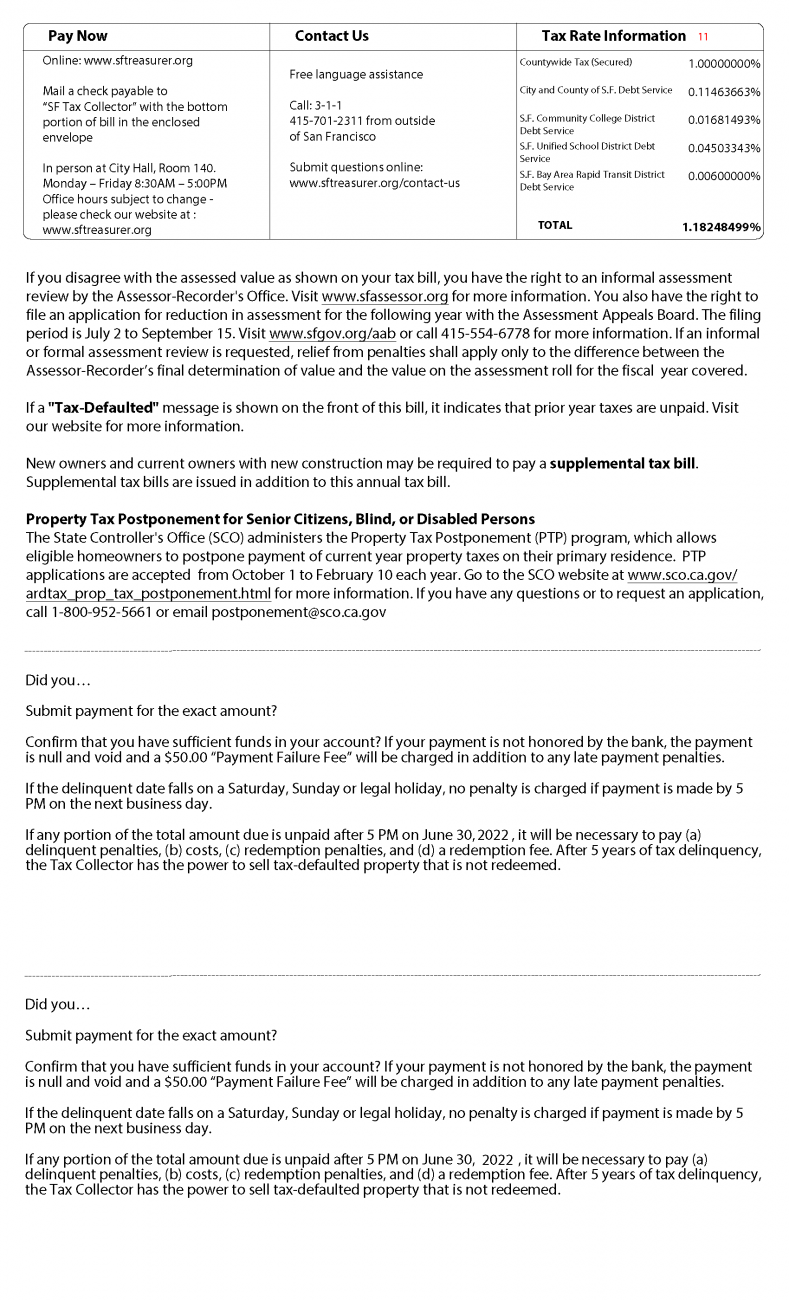

On Monday March 7 2022 the City and County of San Francisco will launch the Be The Jury pilot program in San Francisco Superior Court which will compensate low-to-moderate-income. Property taxes are collected by the County Tax Collector for the City and various other taxes are collected by the State and remitted to the City. For best search results enter your bill number or blocklot as shown on your bill.

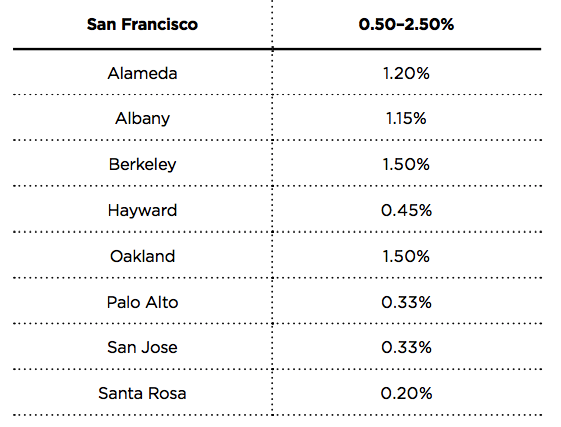

How Property Taxes in California Work. Those entities include San Francisco the county districts and special purpose units that produce that combined tax rate. San Francisco County collects on average 055 of a.

Access and view your bill online learn about the different payment options and how to get assistance form the Citys. For questions regarding property tax. If you received a letter from the Citys collection agency BDR you must pay it immediately.

Property tax collected by each county is payable in two installments. This calculator is designed to help you estimate property taxes after purchasing your home. The Property Tax Rate for the City and County of.

View and pay a property tax bill online. Before we start watch the video below to understand what are supplemental taxes. Learn about the Citys property taxes.

The average effective property tax rate in California is 073. In general unsecured property tax is either for business personal property office equipment owned or leased boats. A Tax Clearance Certificate is a document that certifies there.

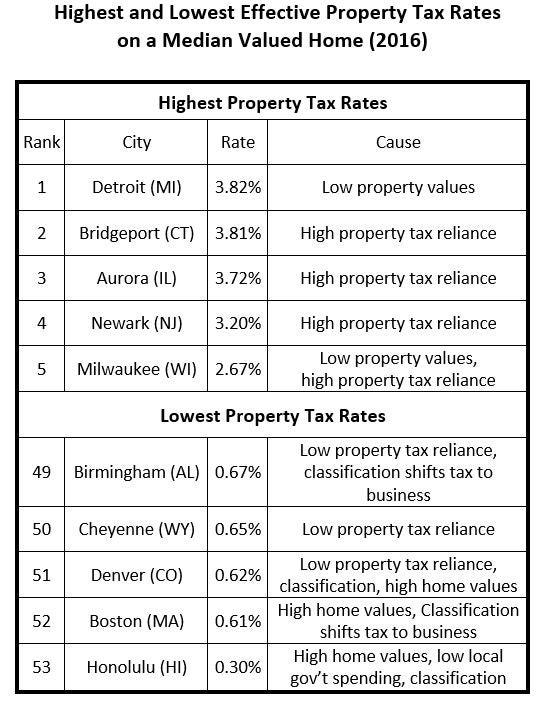

The State of California property tax year is July 1st through June 30th. Businesses must file and pay taxes and fees on a regular basis. This compares well to the national average which currently sits at 107.

Danielle Lazier Vivre Real Estate. Who and How Determines San Francisco Property Tax Rates. Learn about the Citys property taxes.

A requirement for subdivision and condo conversion is to obtain a Tax Clearance Certificate before the final map is recorded. The rebates will amount to 50 for people who reported less than 200000 in revenue on their taxes and claimed a property tax credit. Property tax property taxes San Francisco Property Taxes sf property tax bill tax questions.

Access and view your bill online learn about the different payment options and how to get assistance form the Citys. The secured property tax amount is based on the assessed value of. If you enter your.

The median property tax in San Francisco County California is 4311 per year for a home worth the median value of 785200.

How Low Taxes Lead To High Home Prices In Vancouver Bc Sightline Institute

Property Tax How To Calculate Local Considerations

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Understanding California S Property Taxes

Sf Property Tax Rate Over Time

Secured Property Taxes Treasurer Tax Collector

San Francisco Prop W Transfer Tax Spur

Understanding California S Property Taxes

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

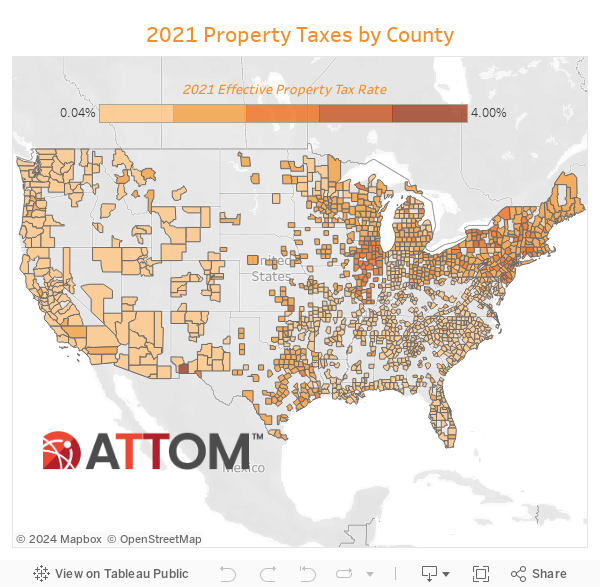

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

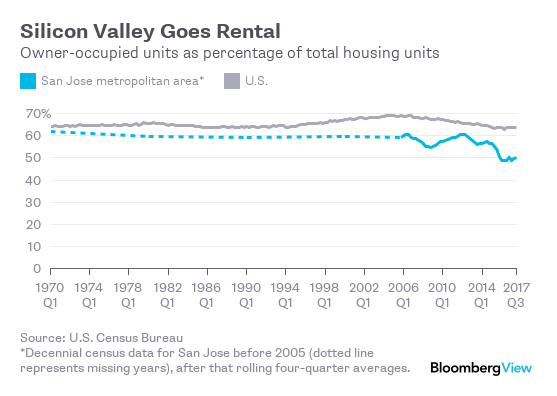

Why Economists Love Property Taxes And You Don T Bloomberg

Understanding California S Property Taxes

How Low Taxes Lead To High Home Prices In Vancouver Bc Sightline Institute

Property Taxes By State Embrace Higher Property Taxes